🔒 Protect Your Investments with Confidence

Even experienced investors can fall victim to sophisticated crypto scams. In 2025, the stakes are higher as fraudsters exploit the growing adoption of cryptocurrencies.

In a landscape where $3.7 billion was lost to crypto scams in 2024 (per Chainalysis), scams are evolving faster than preventive technologies. This guide provides actionable strategies to identify and avoid scams, ensuring the security of your cryptocurrency investments.

✅ Identify warning signs early

✅ Navigate traps on social media, email, and direct messages

✅ Secure your assets effectively

📈 Why Crypto Safety Matters in 2025

Cryptocurrency Adoption Is Surging

Over 562 million people globally used cryptocurrency in 2024, according to Statista. From decentralized finance (DeFi) to non-fungible tokens (NFTs), innovation is booming, but so are opportunities for fraud. Blockchain’s complexity creates vulnerabilities that scammers exploit. Whether trading Bitcoin or exploring the metaverse, robust security is critical.

This guide offers clear, actionable steps to protect your investments and maintain confidence in the crypto ecosystem.

🔐 Understanding the Crypto Threat Landscape

Blockchain’s Strengths Enable Fraud

Decentralization, pseudonymity, and irreversible transactions make cryptocurrencies appealing but vulnerable to exploitation. In 2025, fraudsters leverage artificial intelligence (AI), platforms like X, and psychological tactics to deceive investors.

From phishing emails to fraudulent giveaways, scam tactics evolve rapidly. Staying informed equips you to protect your assets.

The following sections outline the most prevalent blockchain scams and how to counter them.

Common Crypto Scams and How to Avoid Them

Fraudsters deploy sophisticated tactics to target investors. Below are the top crypto scams in 2025, with examples, warning signs, and prevention strategies.

Phishing Scams Targeting Crypto Investors

Phishing scams trick users into sharing sensitive data, such as private keys or login credentials, through fraudulent emails, texts, or social media.

Example:

In February 2025, a phishing campaign spoofing Coinbase’s domain (e.g., support@coinbase-verify.com) urged users to “secure their wallet” via a malicious link, compromising 2,300 accounts.

Warning Signs:

Misspelled email addresses, generic greetings (e.g., “Dear User”), or urgent demands. Hover over links to verify URLs.

Prevention:

Access accounts only through official websites or apps. Bookmark trusted platforms like Coinbase.

Ponzi Schemes: Promises of Easy Profits

Ponzi schemes lure investors with guaranteed high returns, using funds from new investors to pay early participants until the scheme collapses.

Example:

In 2025, “CryptoWealth Fund” promised 30% monthly returns but required constant recruitment, collapsing after eight months and costing investors $15 million.

Warning Signs:

Guaranteed profits or recruitment-driven models.

Prevention:

Verify platforms on CoinDesk.

Fake ICOs: Fraudulent Crowdfunding Risks

Fake Initial Coin Offerings (ICOs) promote nonexistent projects to raise funds, then disappear.

Example:

In April 2025, “AIChain” raised $12 million for a fake “decentralized AI blockchain” with no verifiable team or whitepaper, vanishing after launch.

Warning Signs:

Unregistered offerings, vague whitepapers, or unverified teams.

Prevention:

Check ICO compliance on the SEC’s website.

Rug Pulls in DeFi Projects

Rug pulls occur when DeFi developers drain liquidity pools, crashing token values.

Example:

In 2025, “DeFiYield” saw developers sell 90% of tokens overnight after X hype, leaving investors with worthless assets.

Warning Signs:

Uneven token distribution or suspicious liquidity pool activity.

Prevention:

Use DappRadar.

Impersonation Scams on Social Media

Fraudsters impersonate influencers, exchanges, or celebrities to steal cryptocurrency.

Example:

In June 2025, a fake X account posing as Vitalik Buterin offered a “Bitcoin doubling” giveaway, stealing $1 million.

Warning Signs:

Unverified accounts or unsolicited offers.

Prevention:

Verify accounts via official channels and report fakes on X.

Pump-and-Dump Schemes

Scammers inflate token prices through hype, then sell holdings, causing a crash.

Example:

In 2025, “MoonCoin” surged 500% after X promotions, only for insiders to dump shares, costing investors millions.

Warning Signs:

Sudden price spikes without clear catalysts or heavy social media hype.

Prevention:

Track prices on CoinGecko.

🚩 Top Crypto Scam Warning Signs in 2025

Identifying red flags prevents financial loss. Key indicators include:

- Unrealistic Promises: Offers of 50% weekly returns are fraudulent.

- Lack of Transparency: Legitimate projects disclose team details and plans.

- Pressure to Act Fast: Scammers push quick decisions to bypass research.

- Unverified Teams: Teams without LinkedIn profiles or industry history are suspect.

- Poor Website Quality: Scam sites feature typos or broken links.

Case Study:

In May 2025, a fraudulent exchange, “CryptoFast,” with a typo-laden website and no team details, scammed users out of $3 million.

Due Diligence Checklist for Crypto Investments

Protect your investments with these steps:

- Verify Team Credentials: Check LinkedIn for blockchain experience.

- Confirm Regulatory Compliance: Ensure SEC or FCA registration.

- Analyze Whitepapers: Look for technical clarity and milestones.

- Review Tokenomics: Confirm balanced distribution on CoinGecko.

- Read Independent Feedback: Explore Reddit’s r/cryptocurrency.

Example: A 2025 investor avoided a $50,000 loss by verifying a project’s whitepaper and team on LinkedIn.

🛠️ Essential Tools for Avoiding Crypto Fraud

Enhance security with these resources:

- News and Forums: CoinTelegraph.

- Scam Databases: Check ScamWatch or Better Business Bureau.

- Browser Extensions: HTTPS Everywhere and uBlock Origin block phishing sites.

- Secure Messaging: Use Signal for encrypted discussions.

- Wallet Security: MetaMask and Ledger ensure safe storage.

What to Do If You Suspect a Crypto Scam

Act swiftly to mitigate losses:

- Cease Contact: Stop communication with the scammer.

- Secure Accounts: Update passwords and enable 2FA via Google Authenticator.

- Report the Scam: Notify the SEC, FBI’s IC3, or Interpol’s cybercrime unit.

- Contact Your Exchange/Bank: Report transactions within 24 hours.

- Seek Forensics Support: Consult firms like Chainalysis for fund tracing.

- Pursue Legal Action: Use services like Crypto Fraud Recovery.

Example: In 2025, a victim recovered 60% of stolen funds by reporting a rug pull to Binance within hours.

Emerging Crypto Scam Trends in 2025

Scammers exploit new technologies. Stay vigilant with these insights:

AI-Driven Phishing Scams

AI-generated deepfake videos or emails impersonate trusted figures.

Example: In July 2025, a deepfake of Binance CEO Changpeng Zhao promoted a fake token sale, stealing $750,000.

Prevention: Verify communications via official channels.

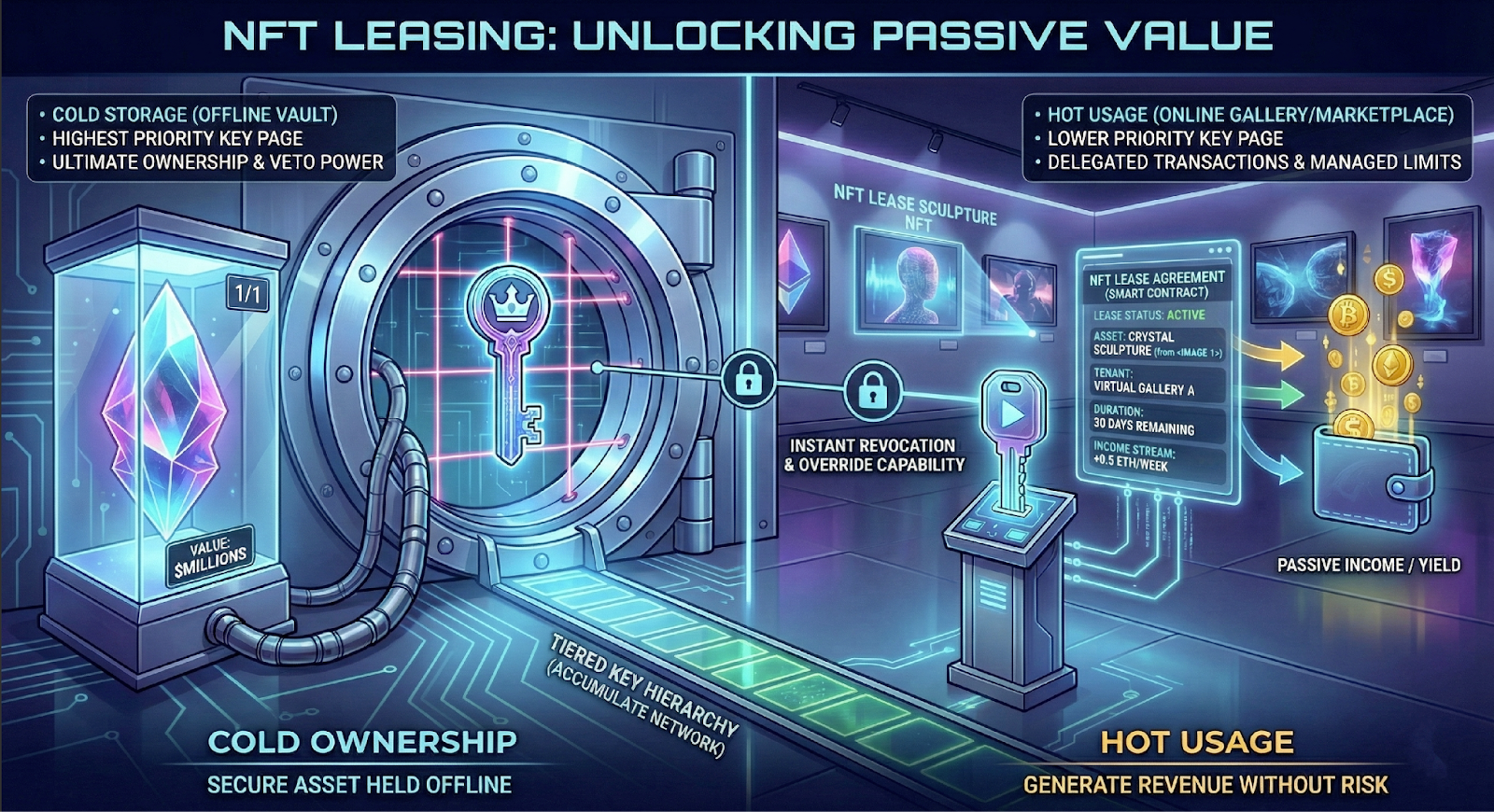

Metaverse and NFT Frauds

Fake NFT projects or virtual land sales exploit metaverse hype.

Example: A 2025 scam sold nonexistent virtual plots on a fake blockchain, costing $2 million.

Prevention: Verify NFTs on OpenSea.

Social Engineering on X

Fake X accounts promote giveaways or impersonate developers.

Example: A 2025 fake X account mimicking a blockchain developer stole wallet keys.

Prevention: Follow verified accounts and report fakes.

Malware in Crypto Apps

Fake wallet apps or extensions steal user data.

Example: A 2025 fake MetaMask extension compromised thousands of wallets.

Prevention: Download from official sources like MetaMask.

" AI and social platforms amplify scam sophistication in 2025"

🔐 Future-Proofing Your Crypto Security

Stay proactive with these strategies:

- Monitor Trends: Follow CryptoBitMag’s Trends for updates.

- Use Hardware Wallets: Store assets offline with Ledger.

- Audit Holdings: Check balances weekly.

- Join Communities: Engage on Reddit’s r/cryptocurrency.

- Learn Continuously: Attend Kraken webinars.

Case Study: In 2025, an investor avoided a $50,000 loss by using a Ledger wallet and verifying a whitepaper.

Best Practices for Long-Term Crypto Security

Adopt these habits:

- Strong Passwords: Use LastPass for unique, 16-character passwords.

- Enable 2FA: Set up Google Authenticator on exchanges.

- Update Software: Patch wallets like MetaMask regularly.

- Stay Educated: Join Kraken webinars for 2025 trends.

- Build a Network: Share scam alerts on r/cryptocurrency.

🌱 Tips for New Crypto Investors

Start safely with these steps:

- Learn Key Terms: Understand private keys and liquidity pools.

- Start Small: Invest only what you can afford to lose.

- Use Reputable Exchanges: Trade on Binance or Coinbase.

- Ask Questions: Engage on Reddit.

Example: A 2025 beginner saved $5,000 by consulting r/cryptocurrency about a suspicious ICO.

Summary of 2025 Crypto Scams

| Scam Type | Warning Signs | Prevention Tools |

|---|---|---|

| Phishing | Misspelled URLs, urgent demands | HTTPS Everywhere, official apps |

| Ponzi Schemes | Guaranteed profits, recruitment focus | CoinDesk, Bitcointalk |

| Fake ICOs | Vague whitepapers, unverified teams | SEC database, LinkedIn |

| Rug Pulls | Uneven token distribution | DappRadar, CoinGecko |

| Impersonation | Unverified social media accounts | X verification, official channels |

| Pump-and-Dump | Sudden price spikes, social media hype | CoinGecko, market analysis |

Conclusion: Secure Your Crypto Journey in 2025

Crypto scams remain a persistent threat, but with vigilance and knowledge, you can protect your investments. Recognize warning signs, verify projects, and adopt robust security practices.

✅ Secure accounts with 2FA and hardware wallets

✅ Conduct thorough due diligence before investing

✅ Engage with trusted communities like r/cryptocurrency

Stay ahead of fraudsters—start implementing these strategies today.

Discussion