Your Definitive 2025 Guide to Secure Decentralized Finance

Introduction

Decentralized Finance (DeFi) is transforming the global financial landscape by eliminating traditional intermediaries such as banks and brokers. By leveraging blockchain technology, DeFi offers unmatched financial freedom, inclusivity, and transparency, captivating investors, developers, and everyday users worldwide. In 2025, with over $200 billion in total value locked (TVL) in DeFi protocols, the ecosystem continues to grow, driven by innovations like layer-2 scaling and cross-chain interoperability (source: DeFiLlama).

Whether you are a novice or an experienced investor, understanding DeFi wallets, staking, investment strategies, and secure asset management is critical to safely harnessing DeFi’s potential.

The Evolution of Decentralized Finance (DeFi)

DeFi represents a paradigm shift in finance, utilizing blockchain technology to deliver open, permissionless, and decentralized financial services accessible to anyone with an internet connection.

Why DeFi Matters in 2025

- No Intermediaries: Eliminates reliance on banks, brokers, or clearinghouses, reducing costs and enhancing autonomy.

- Global Access: Enables unbanked and underbanked populations to access financial products.

- Transparency: Transactions are publicly auditable on blockchain ledgers, ensuring trust.

- Reduced Costs: Lower fees compared to traditional finance, thanks to smart contract automation.

- Innovation: Introduces novel financial products like yield farming, liquidity mining, decentralized exchanges, and tokenized real-world assets (RWAs).

Key DeFi Services

Service | Description | Examples |

|---|---|---|

Lending & Borrowing | Peer-to-peer loans without intermediaries | Aave, Compound |

Decentralized Exchanges (DEX) | Trade crypto assets without centralized authority | Uniswap, SushiSwap |

Yield Farming | Provide liquidity and earn rewards | Yearn Finance, Balancer |

Stablecoins | Crypto pegged to fiat currencies | USDC, DAI |

Real-World Assets | Tokenized assets like real estate or invoices | Centrifuge, MakerDAO |

Is a DeFi Wallet Safe? What You Need to Know

Your DeFi wallet serves as the gateway to the decentralized economy. However, wallet security depends significantly on your choices and practices.

Types of DeFi Wallets and Security Considerations

Wallet Type | Security Level | Benefits | Limitations |

|---|---|---|---|

Software Wallets | Medium | Easy access, highly compatible | Vulnerable to malware, phishing |

Hardware Wallets | High | Private keys offline, robust security | Higher cost, less convenient |

Paper Wallets | High (if stored securely) | Cold storage, offline | Prone to physical loss/damage, complex setup |

Security Tip: Hardware wallets like Ledger Nano X or Trezor provide superior protection for long-term holdings due to offline key storage.

How DeFi Wallets Protect Your Assets

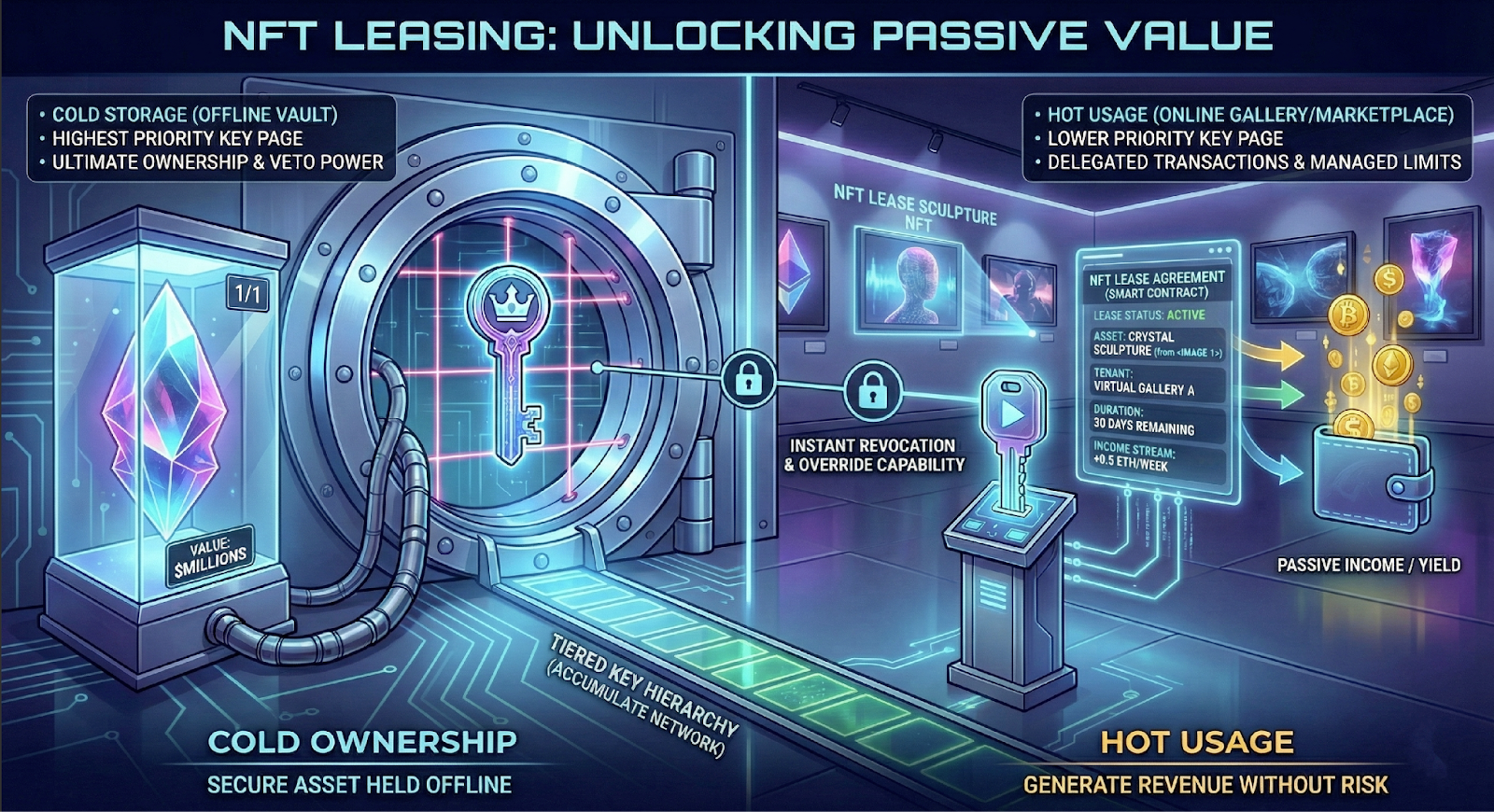

DeFi wallets enable self-custody, meaning you alone control your private keys. This enhances security but places full responsibility on you to safeguard access.

Core Security Features to Look For

- End-to-End Encryption: Protects private keys and transaction data.

- Two-Factor Authentication (2FA): Adds an extra layer of login security.

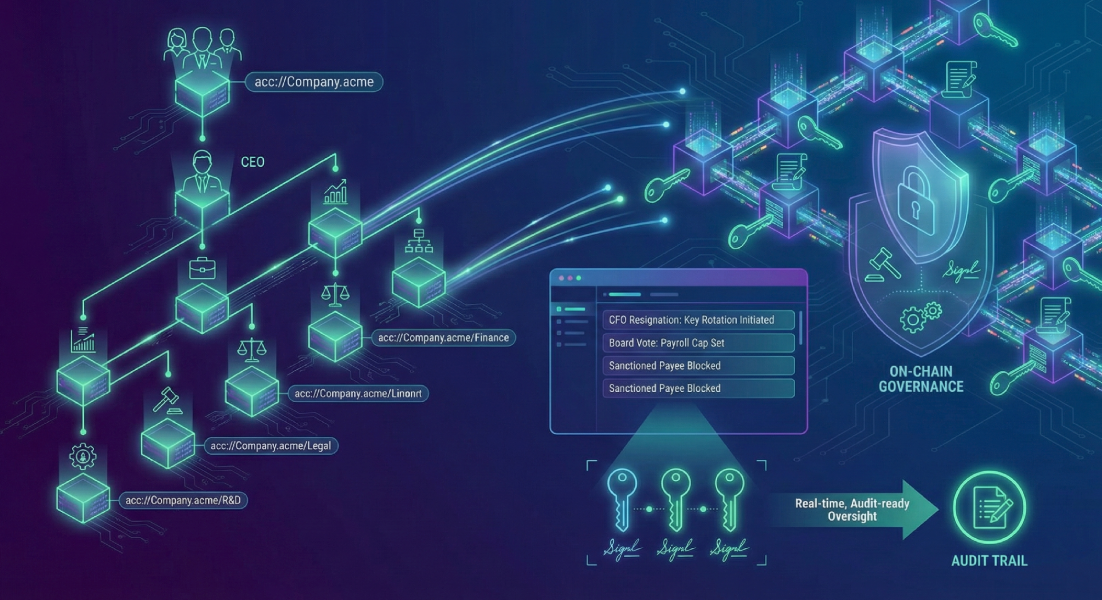

- Multi-Signature Wallets (Multi-sig): Requires multiple approvals for transactions, reducing fraud risk.

- Biometric Access: Fingerprint or face ID enhances usability and security.

- Backup & Recovery: Seed phrases must be stored offline in secure locations.

- Frequent Software Updates: Address vulnerabilities promptly.

- Active Developer Support: Ensures rapid response to emerging threats.

- Smart Contract Auditing Integration: Tools like MetaMask’s transaction simulation detect malicious contracts (source: Metamask Security).

- Decentralized Recovery Protocols: Social recovery mechanisms (e.g., Argent’s guardian system) restore access without compromising keys.

Common Vulnerabilities

- Phishing Attacks: Fake websites or apps steal credentials.

- Malware: Keyloggers or viruses target software wallets.

- User Error: Lost private keys or seed phrases are irrecoverable.

- Smart Contract Risks: Interacting with unverified protocols can lead to fund loss.

Choosing the Right DeFi Wallet in 2025

A secure wallet balances usability, compatibility, and robust security features.

Recommended Wallets

Wallet | Type | Best For | Platforms Supported |

|---|---|---|---|

MetaMask | Software | Web3 beginners & dApp users | Ethereum, Binance Smart Chain, Polygon |

Trust Wallet | Software | Mobile users | Multi-chain, mobile-first design |

Ledger Nano X | Hardware | High-security storage | Integrates with software wallets |

Coinbase Wallet | Software | Fiat on/off ramps and ease | Ethereum, Polygon, Binance Smart Chain |

Rabby | Software | Advanced users, security-focused | Ethereum, layer-2 networks |

Note: Emerging wallets like Rabby offer transaction simulation to detect malicious contracts, while mobile-first wallets like Zerion provide integrated portfolio management.

How to Invest in DeFi: A Comprehensive Guide

DeFi offers diverse opportunities but requires careful planning and education.

Step 1: Educate Yourself

- Understand blockchain and smart contract fundamentals.

- Follow trusted sources like Coindesk.

- Engage with communities on Reddit, Telegram, and Discord for insights.

Step 2: Select a Secure Wallet

- Choose wallets with robust security features (e.g., 2FA, multi-sig).

- Store seed phrases offline in fireproof, secure locations.

- Use hardware wallets for large holdings.

Step 3: Fund Your Wallet

- Transfer crypto from exchanges or other wallets.

- Start with small amounts to test processes.

- Use layer-2 networks (e.g., Polygon, Arbitrum) to reduce gas fees.

Step 4: Choose a Reliable DeFi Platform

- Select audited protocols with strong community and developer support.

- Verify audits from firms like Certik or Trail of Bits.

Step 5: Explore Investment Options

- Yield Farming: Earn fees by providing liquidity to pools.

- Staking: Lock tokens to secure networks and earn rewards.

- Lending: Loan assets for interest payments.

- Token Swapping: Trade assets to diversify or speculate.

- Real-World Asset (RWA) Tokenization: Invest in tokenized assets like real estate (e.g., Centrifuge).

Step 6: Monitor & Manage

- Regularly review your portfolio using tools like Zerion or DeBank.

- Stay updated on market trends and protocol upgrades via X and CoinTelegraph.

- Adjust strategies to minimize risks and optimize returns.

Popular DeFi Investment Strategies in Detail

Strategy | Description | Risks | Rewards |

|---|---|---|---|

Yield Farming | Provide liquidity to pools for rewards | Smart contract risks, impermanent loss | High APYs, token incentives |

Staking | Lock tokens to validate transactions | Lock-up periods, contract bugs | Passive income, network rewards |

Lending | Loan tokens for interest payments | Borrower defaults, liquidation risk | Stable returns, compound interest |

Token Swapping | Exchange tokens on decentralized exchanges | Market volatility | Portfolio diversification, trading profits |

RWA Tokenization | Invest in tokenized real-world assets | Regulatory risks, protocol reliability | Stable returns, low volatility |

Trend Alert: Restaking protocols like EigenLayer allow users to stake assets across multiple networks for compounded rewards, but they increase smart contract risk.

Risks and Rewards: What You Must Understand

Major Risks

- Smart Contract Exploits: Bugs can lead to fund loss, as seen in the 2024 Mango Markets $100 million hack.

- Market Volatility: Crypto prices fluctuate significantly.

- Regulatory Uncertainty: Evolving laws, such as the EU’s MiCA regulation, may impact DeFi operations.

- User Errors: Lost keys or phishing scams are irrecoverable.

Rewards to Aim For

- Higher yields than traditional finance, often exceeding 5–10% APY.

- Full ownership and control of assets.

- Early access to innovative products like decentralized derivatives and RWAs.

What Is DeFi Staking and How Does It Work?

DeFi staking involves locking tokens in a protocol’s smart contract to support blockchain functions like transaction validation and network security.

How Staking Works

- Users delegate tokens to a network or protocol.

- Rewards are earned based on the amount staked and network conditions.

- Transactions are managed transparently via smart contracts.

- Liquid staking (e.g., Lido’s stETH) allows users to use staked assets in other protocols.

Popular Staking Platforms

Platform | Supported Chains | Reward Range (APY) | Lock-Up Period | Security Features |

|---|---|---|---|---|

Lido Finance | Ethereum, Polygon | 3–7% | None (liquid staking) | Audited, decentralized validators |

Rocket Pool | Ethereum | 4–8% | Variable | Decentralized node operators |

Ankr | Multi-chain | 5–10% | Flexible | Enterprise-grade security |

Benefits of Staking

- Earn passive income without selling tokens.

- Enhance blockchain security and decentralization.

- Potential appreciation of staked tokens.

Risks of Staking

- Lock-up periods restrict access to funds.

- Smart contract vulnerabilities may lead to losses.

- Market fluctuations can reduce gains.

Connecting Crypto.com to Your DeFi Wallet: A Step-By-Step Guide

Integrating Crypto.com with a DeFi wallet enables seamless asset management and access to DeFi services.

Step-by-Step Guide

- Download a Compatible Wallet: Choose MetaMask, Trust Wallet, or similar.

- Create or Import Wallet: Use your private key or seed phrase to set up.

- Verify Network Compatibility: Ensure the wallet supports Crypto.com’s chains (e.g., Cronos, Ethereum). Add Cronos manually if needed.

- Log In to Crypto.com: Access your account via the app or web.

- Transfer Funds: Copy your DeFi wallet address, enter it in Crypto.com’s transfer section, and confirm.

- Account for Gas Fees: Use layer-2 networks like Polygon for lower fees.

- Confirm Transaction: Monitor the blockchain via Etherscan or Cronos Explorer.

Benefits of Integration

- Simplified asset transfers between centralized and decentralized platforms.

- Enhanced security through self-custody.

- Direct access to lending, staking, and yield farming.

How to Transfer Money from a DeFi Wallet to a Bank Account

Converting crypto to fiat and withdrawing to a bank account involves several steps.

Step-by-Step Transfer Guide

Step | Action |

|---|---|

1. Select Exchange | Use a fiat-supporting exchange (e.g., Coinbase, Binance) |

2. Transfer Crypto | Send tokens from your DeFi wallet to the exchange wallet |

3. Convert to Fiat | Exchange crypto for your preferred fiat currency |

4. Withdraw to Bank | Request withdrawal to your bank account via ACH or wire |

5. Confirm & Monitor | Verify funds arrive in your bank account |

Fees & Timing

- Exchange fees typically range from 0.1% to 1%, depending on the platform and method.

- Withdrawals may take hours to days, with bank policies adding processing time.

- Stablecoin transfers on layer-2 networks reduce gas costs significantly.

Security Best Practices

- Double-check wallet addresses before transferring.

- Enable two-factor authentication (2FA) on exchanges and wallets.

- Maintain transaction records for accountability.

Best Practices for Safe DeFi Usage

- Store seed phrases in offline, fireproof locations (e.g., a safe).

- Use hardware wallets for significant holdings.

- Avoid phishing by verifying website URLs and app authenticity.

- Keep software and wallets updated to patch vulnerabilities.

- Never share private keys or seed phrases.

- Start with small investments to test platforms and strategies.

- Use tools like Etherscan to verify smart contract security.

- Explore decentralized identity (DID) solutions for enhanced privacy.

Conclusion

Decentralized Finance in 2025 offers transformative opportunities for financial empowerment, but its complexity demands vigilance. By selecting secure wallets, leveraging audited protocols, and staying informed about trends like liquid staking and RWA tokenization, users can confidently navigate the DeFi ecosystem. Adopting best practices—such as offline seed phrase storage, hardware wallet usage, and transaction verification—ensures asset safety. As regulations like MiCA evolve, staying compliant and proactive will safeguard your DeFi journey. Begin with small, calculated steps, and unlock the potential of decentralized finance with informed confidence.

Frequently Asked Questions (FAQ)

Is a DeFi wallet really safe?

DeFi wallets are secure when equipped with encryption, 2FA, and proper key management. Self-custody requires personal responsibility to avoid phishing and user errors.

Which DeFi wallets are best in 2025?

MetaMask, Trust Wallet, Ledger Nano X, Coinbase Wallet, and Rabby are top choices, balancing security, usability, and multi-chain support.

How do I start investing in DeFi?

Learn blockchain basics, select a secure wallet, fund it, choose audited platforms, and explore options like staking, yield farming, or RWA tokenization.

What risks should I be aware of in DeFi staking?

Risks include lock-up periods, smart contract vulnerabilities, and market volatility. Liquid staking introduces depegging risks.

How do I transfer crypto from my DeFi wallet to my bank?

Send crypto to a fiat-supporting exchange, convert to fiat, and withdraw to your bank account, ensuring 2FA and address verification.

What are the tax implications of DeFi investments in 2025?

Staking, yield farming, and token swapping may trigger taxable events (e.g., capital gains, income tax). Consult a tax professional and use tools like Koinly.

How can I verify a DeFi protocol’s security?

Check for audits by Certik or Trail of Bits, review community feedback on X, and verify contract code on Etherscan.

"Decentralized Finance empowers you to control your financial future. Stay educated, secure, and proactive to thrive in the DeFi revolution."

Take the First Step Towards DeFi Empowerment

Secure your financial future today. Choose a trusted wallet, explore audited DeFi platforms, and invest wisely. The decentralized revolution is here—join it with confidence.

Start now — Your DeFi wallet awaits!

Discussion